Seeking direction.

The markets had a slow start in the new year with many people recovering from well-deserved holidays and less hungry than usual after all festivities. There is a lot of wait and see with the many uncertainties and not in the least about what happens after the inauguration of Donald Trump as president on January 20th.

But whether it is about export of US soybeans to China, imports of Canadian rapeseed oil into the US or about US biofuels policy, there are too many uncertainties about the future decisions of the Trump administration, meaning the market may not set a clear direction until there are clear answers. And if for some reason soy takes off, the tide will rise all boats.

Petroleum

Are the bulls back?

Petroleum markets started the year with revived optimism, driven by stock draws in the US and China's strive to stimulate its economy. Since mid-December, traders and speculators also began building net long positions on the assumption that president-elect Trump wants tougher sanctions against Iran, i.e., disrupt Iranian crude exports to China. Prices rose sharply to a 3-month high, fueled by more inputs such as a cold spell in EU and the US, fueling demand for heating oil, higher natural gas prices prompting G2O switches, and tougher US sanctions targeting Russian oil exports. Especially, the Russian shadow tanker fleet (carrying Russian, Venezuelan and Iranian cargo). This could disrupt global supplies, in particular, Russian exports to its main customers India and China. It is hard to say how this turns out mid- to long-term with India emerging as the main driver of global petroleum demand growth. But it looks constructive.

Palm oil

The monthly performance report from the Malaysian Palm Oil Board, last Friday, showed that Malaysian crude palm oil production in December fell 8.3% to 1.49Mmt. On weak demand, month on month exports dropped nearly 10% and total palm oil end of month stocks dropped for the third consecutive month to a 19-month low of 1.71Mmt (vs. abt. 2.2Mmt in 2022 and 2023).

In response to the report's low ending stocks, last Friday, March '25 Palm oil futures settled at MYR 4,391/mt, halting (temporarily?) weeks of decline. Prices also rebounded from their lowest level in weeks of MYR 4295 on January 9th, on optimism that Chinese demand could increase ahead of the Lunar New Year festivities on January 29th welcoming the Year of the Snake and kicking off the 16-day Spring Festival.

It must however be noted that China has increased its soybean imports and crush which results in more availability of cheaper soybean oil which in turn reduces the need for vegetable oil imports.

Weak overall demand and cheaper competing oils remain a concern even though the sentiment of overall tight supplies in the 1st quarter prevails. High prices have clearly curbed demand and palm oil has been tracking the soybean complex. It is also striking that prices dropped during a dropping production period. But palm oil remains the most expensive one. Things may change when production picks up and stocks start building. Palm oil may then very well have to become again the cheapest oil to recover lost market share. One swing factor to watch is the evolution of the biodiesel production and usage in Indonesia.

Soybean oil

If no major production problems occur, South America is bound for a record soybean crop and global ending stocks are expected at unusual record high levels. There is some nervousness and concern about weather conditions in South America, however. Especially about Argentina, where heat is scorching the soybean growing region, with no rain for three to four weeks and temperatures topping 40°C. At the same time, in Mato Grosso, a major Brazilian soybean production area, where harvest is about to begin, heavy rains must stop to allow harvesting...

In Chicago, soybean (Mar '25 $10.25/bu.) and soybean oil (Mar '25 $0.4558/lbs.) futures closed sharply higher last Friday after the USDA made supply cuts in the January 10 WASDE report. The 2024 crop was big but not quite as big as forecast last fall. Soybean yields were reduced by 1 bu./acre due to extremely low moisture content at harvest (=3.41 mt/ha), resulting in a drop in production weight and bringing US end stocks down to 10.34Mmt. From one month to the other, 0.58% of global production or 2.46Mmt of soybeans 'evaporated' which is good for prices, but overall upside potential is limited due to the expected South American record crop, the historically low Brazilian real and (fear for) possible crippled exports due to the Trump administration's trade policies.

Ahead of the WASDE report, soybean prices rose initially due to an increase in soybean oil prices, driven by expectations that the Biden administration would announce favorable guidelines for tax credits on biofuels. The tax credit, known as Section 45Z, is important to the biofuels industry, but the announcement, last Friday, did not provide the desired level of clarity and left most of the crucial details and interpretations to the incoming Trump administration. The tax subsidies can be claimed beginning this year.

In the US, large stocks of oils and fats and muted demand from the biofuel industry, end last year and for the beginning of 2025, pressured domestic prices which nurtures soy oil export business.

Global demand for soybean oil has been extremely good, mostly at the expense of less competitive palm oil. In the end the price gap between palm and soy might narrow further but soybeans and soy oil will both need more bullish news to continue to rally.

Rapeseed oil

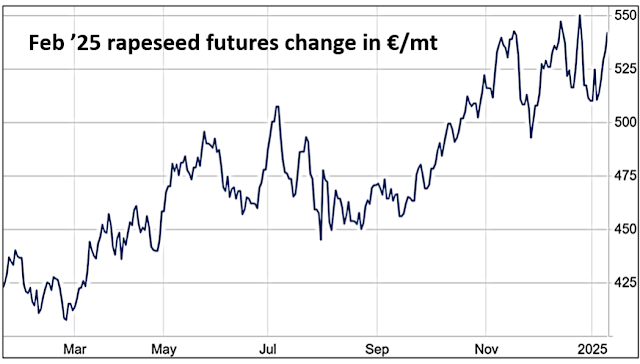

Rapeseed prices in EU are being torn between the support of rising petroleum prices and the pressure of weaker Canadian rapeseed oil and rapeseed markets on top of a good Australian rapeseed crop. Price volatility remains high in a market subject to the instability of the vegetable oils complex. Palm oil in particular has seen a quite rapid downward price correction. Last Friday Feb '25 rapeseed futures closed up at €542.75/mt.

Canadian rapeseed remains attractive to European importers and the arrival of shipments in EU increases the pressure on prices a bit more. Rapeseed benefitted from the stronger dollar and the rise in petroleum prices recorded since mid-December although biodiesel activity remained limited.

In Canada rapeseed futures fell under pressure from worries about reduced demand from the US because Trump has threatened tariffs against Canada, which could hurt demand for Canadian rapeseed (oil). But a good seed offtake by China supported prices.

Generally, the uncertain biodiesel situation in EU and in the US will for a great part determine where this market is heading. In any case EU, like every other year, needs to import seed; but at what price

Sunflower seed oil

In the past weeks, and with the holiday break, there hasn't been much market activity. Except maybe for Russia which keeps pushing oil exports to mostly India. Fundamentals are unchanged and farmer selling activity remains low. The general market sentiment was a touch weaker in the 6-ports sunflower seed oil market which is trading in a carry, meaning there is more than enough oil at the front end. And a surplus of cheap soybean oil has indeed provided some relief in a tight market. Also, usually, at the beginning of the year after the festivities, bottled oil demand is somewhat subdued.

§§§

§§§